Buyer Beware: Overpriced Diagnostic Imaging Centers

Going Independent to Save Money

Independent outpatient facilities that are privately owned and do not belong to a hospital network are giving brand-name hospital chains and healthcare conglomerates a run for their money. Nowhere is this trend more apparent than in the diagnostic imaging field where independent facilities unencumbered by contracted rates are able to offer their patients and customers 50 to 80 percent off for the same diagnostic exams as those performed at a hospital.

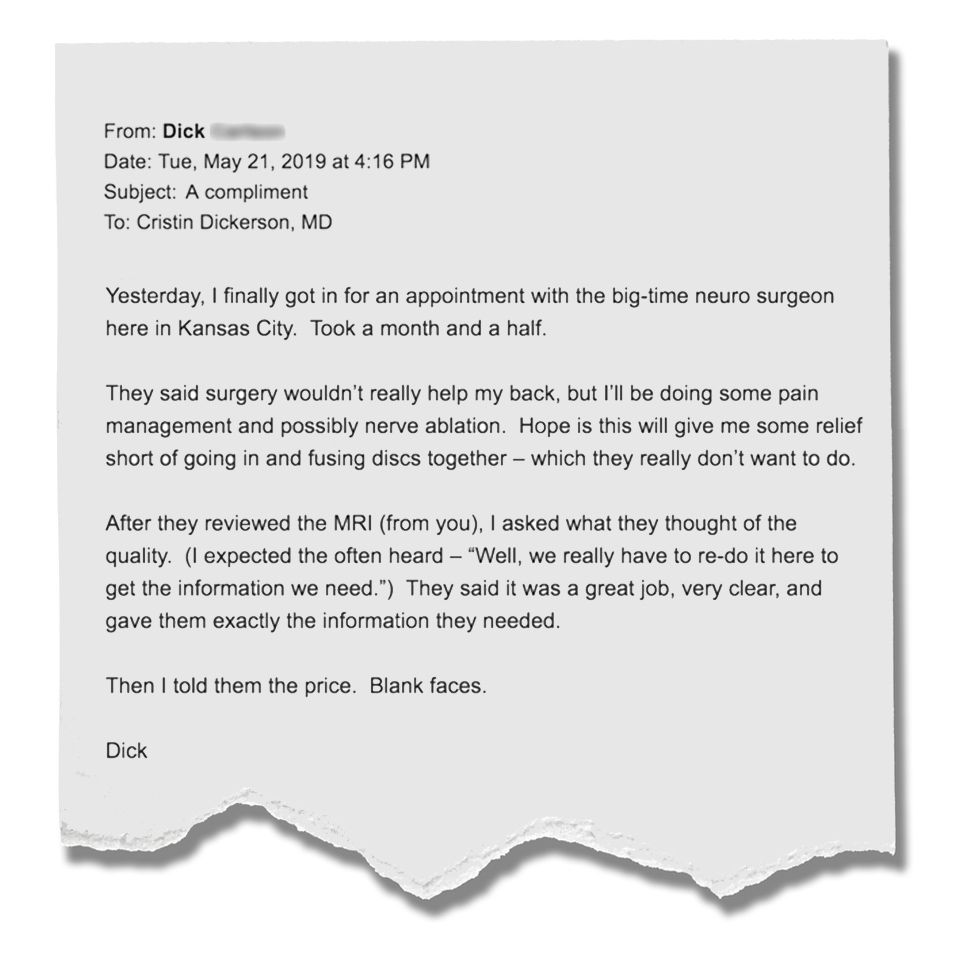

Many of these imaging facilities offer better, faster service, similar technologies, and even contract the same radiologists who do readings for hospitals. Rather than paying over $2,000 at a hospital’s imaging center or an outpatient facility run by a hospital chain, patients could be paying one-fourth that price at an independent imaging provider like Green Imaging.

If you think these price differences between independent operators and the big guys is an exaggeration, consider this: in 2014 Nerdwallet found that the average cost of an MRI in the United States was $2,611. In comparison, Green Imaging, an independent network of imaging centers with over 400 locations, offers MRIs for as little as $250. More importantly, Green Imaging and many independent operators unaffiliated or beholden to regional hospital chains utilize many of the same experienced radiologists as the large hospital providers.

The question is, do we need health insurers acting as middlemen between our doctors and us?

A Wolf in Sheep's Clothing

Of course, the big players in the healthcare field haven’t been wasting any time in attempting to deal with this new threat to their pricing monopoly. Many hospital chains have not only been buying out independent imaging outfits outright and building their own branded outpatient facilities, but they’ve also even started purchasing majority stakes in local and independent imaging facilities without changing the outward trade dress.

All of this behind the scenes business on the part of large hospital networks is designed to hoodwink consumers who don’t know any better. Many patients assume that the lack of a corporate logo on the front door of an imaging facility must mean that it is an independent facility who will give them fair pricing for diagnostic services.

Nothing could be further from the truth.

Instead, many of these faux-indie imaging providers are nothing more than operating fronts for the very same corporate giants and hospital monopolies driving up healthcare prices around the country. Most of these hospital-controlled but unbranded imaging facilities even process their payments directly through the hospital's processing systems. More importantly, that means their services are priced according to the hospital’s contracted and negotiated rates.

Rather than getting a good deal, many patients that enter the doors of these hospital-owned facilities end up with a higher-than-expected bill for simple, standard, and straightforward procedures. Worse, many unsuspecting patients and consumers don’t even know they’re getting stuck with an inflated bill.

Of course, this is no mistake on the part of hospital chains. This is an intentional strategy to pull the wool over consumers’ eyes. They are wolves in sheeps’ clothing.

"Practices such as hiding the true cost of procedures from consumers, or forcing consumers to only go to preferred in-network facilities, not only make the market less free, it makes it much easier to extract money from consumers."

--- DR. CRISTIN DICKERSON, MD

High Deductibles, High Rewards for Hospitals

The financial incentives behind this move towards both branded and unbranded outpatient facilities on the part of hospitals is a response to the growing trend of more and more people enrolled in High Deductible Health Plans (HDHPs). According to the National Center for Disease Control and Prevention (CDC), there has been an unmistakable and conspicuous rise in people with such plans.

HDHPs are defined as health insurance policies with higher deductibles than traditional plans offered by health insurers. Individuals with HDHPs may pay lower monthly insurance premiums but end up paying far more out of pocket for medical expenses until their deductible is met and even after. For many, these deductibles could be as much as four thousand to six thousand dollars. What this means is that until that deductible threshold is met, patients must pay themselves for various medical procedures and treatments.

According to CDC data, this type of coverage has dramatically increased in market share over the past decade. 43.2% of Americans are now on high deductible plans.

The percentage of adults enrolled in an HDHP with an HSA also increased from barely 5 percent to nearly 19 percent a decade later. Even the Affordable Care Act (ACA), also known as Obamacare, did very little to stem the middle-class retreat into HDHPs as the only reasonably affordable way to gain nominal healthcare coverage.

With so many High Deductible Health Plan enrollees in the market, it only makes sense for hospitals to try to get a slice of the pie. More importantly, HDHPs incentivize hospitals to charge inflated prices for essential services. Currently, the maximum out-of-pocket exposure Obamacare regulations will allow is a whopping $7,150 deductible for an individual and $14,300 for a family.

While many hospitals and hospital systems are nonprofits in name, they are run like businesses. Many hospital CEOs are compensated like the CEOs of Fortune 500 corporations. Hospital CEO compensation at "Not For Profit" hospitals have increased by 93% since 2005, from an average of 1.6 million a year to 3.1 million.

Buyer Beware

Hospital chains and regional health provider monopolies don’t always openly disclose the facilities and outpatient operations they own and operate. In some cases, this is an intentional strategy designed to foster the appearance of an independent healthcare facility or medical services provider. In reality, these operations charge nearly or the same prices as their centralized hospital facilities do.

When possible, healthcare consumers and patients should shop around for healthcare services, compare prices, and make an informed decision. With the rise of High Deductible Health Plans (HDHPs), this is more important than ever and could save you and your family hundreds if not thousands of dollars.

Cash Pay Can Be Good for Everybody

If you do not expect to meet your deductible this year and are on a high deductible plan, you are essentially a cash pay patient.

For physicians and other providers, receiving payment in cash means that they don’t have to go through the hassle of navigating health insurance bureaucracy to accept payment for services rendered. Many providers offer a discount for direct pay patients since it saves them the time and the money of having a staff member deal with insurers.

Meanwhile, as long as patients continue to pay their premiums, the insurance companies are not affected. However, that does beg the question: do we need health insurers acting as middlemen between our doctors and us?

DR. CRISTIN DICKERSON, MD