Spike in Health Insurance Cost Could Have You Looking For Alternatives

Introduction To 6 Health Insurance Alternatives

Traditional health insurance has always been confusing and expensive. Complicated insurance rules and regulations make it challenging to know the end cost of a health care bundle. Complex plan coverages, shifting provider networks, and obscure pricing make understanding your healthcare costs difficult. Even worse, a new study finds that the average family's health insurance premiums are expected to spike up to 40% as a result of COVID-19. In light of this, it's now more important than ever to explore affordable alternatives to traditional health insurance.

6 Health Insurance Alternatives

1. Direct Primary Care (Primary Care Membership)

A direct primary care (DPC) membership cuts out the middleman (insurance providers). Instead of your doctor being paid by filing insurance claims, primary care memberships are a subscription directly with your healthcare provider. That monthly fee goes straight to your healthcare provider instead of an insurance company, cutting out the unnecessary middlemen. With fewer administrative processes bogging things down, you'll have more thorough appointments and more face-to-face time with your physician. These doctors are also committed to your long term healthfulness and your financial well being. By offering you 24/7 care, they can help you avoid expensive ER and urgent care visits, help you find low-cost labs and imaging and specialty care, and bundled price surgery when absolutely needed.

Because catastrophic health crises do occur, many direct primary care doctors offer an association plan through a medical cost-sharing entity to cover big-ticket events. Additionally, there are nontraditional insurance plans like Decent, that include a direct primary care membership. The cost-sharing entity, Sedera's ACCESS plan affordably pairs direct primary care and catastrophic coverage. Houston peeps, our friend Dr. Goyal's First Primary Care Association plan can be explored here. For more information about the plan, click here and select “Primary365 + Complete” in the Membership tab.

2. Medical Cost-Sharing Programs

Medical cost-sharing programs are not considered insurance plans. They're run by companies that collect regular "sharing fees" similar to health insurance premiums. This pool of money is then used to cover the medical needs of program members, regardless of pre-existing conditions.

While there are no requirements to qualify for a medical cost-sharing program, they do not promise payments because they do not use contracts as a health insurance company does. In essence, health insurance contracts stipulate what is covered, what percentage your insurance company covers, and what is not covered. Under a medical cost-sharing program, you are essentially asking other members to help pay for a portion of your medical expenses.

Medical cost-sharing programs have a few benefits in addition to a markedly lower price tag. Unlike a traditional health insurance plan that has specific providers under their network coverage, you can choose any health care provider you want. Furthermore, paying for low-cost items in cash can let you negotiate a lower rate than the contracted rate you would pay using insurance if you have not met your deductible. Drawbacks of medical cost-sharing programs include the lack of underwriting of the plans and some preexisting conditions being excluded.

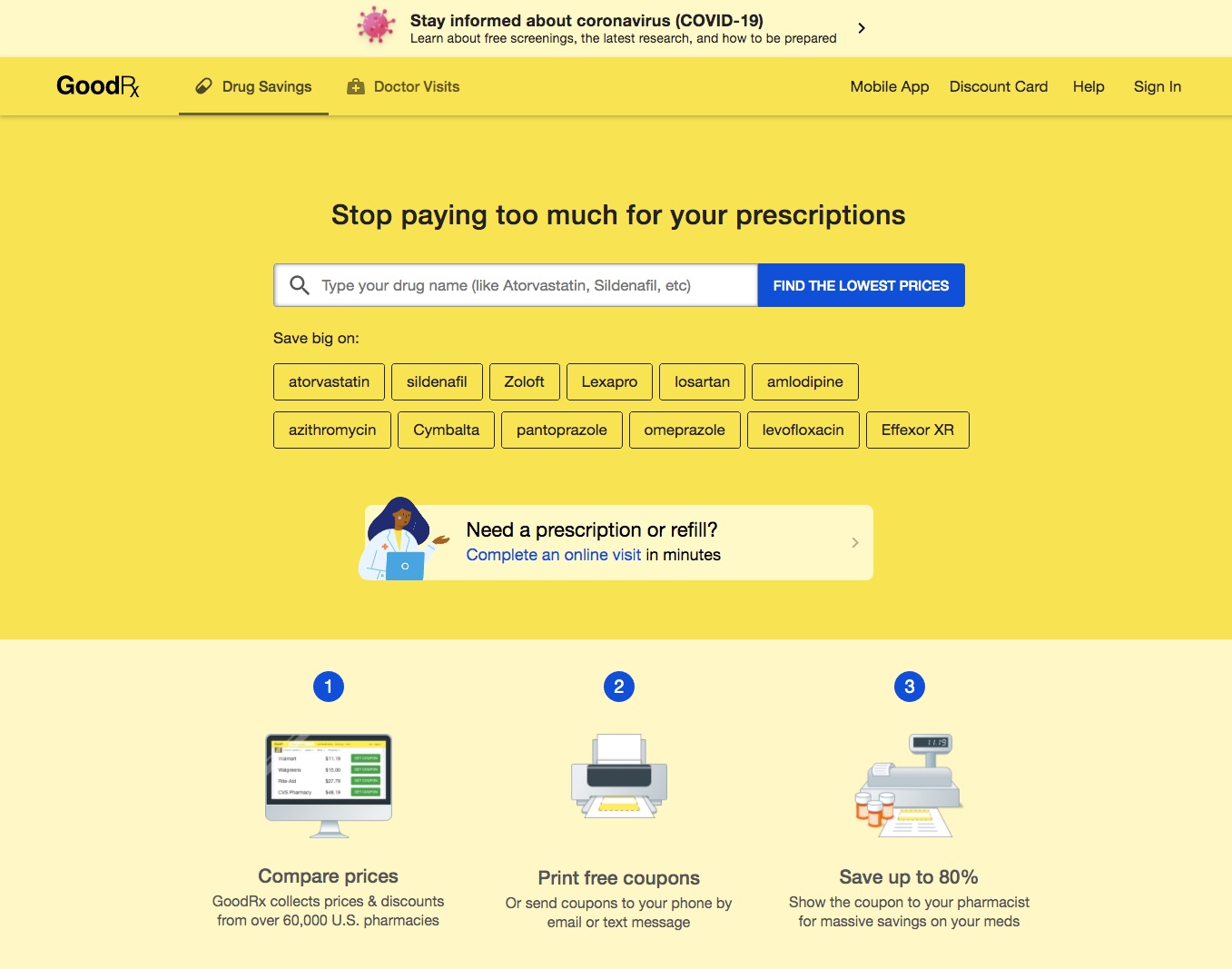

3. Medical Services Discount Cards

Pharmacy or medical services discount cards are not considered a form of traditional health insurance. Instead, they provide discounted fees for medical services. While this card is not a replacement for a health insurance plan, it can be used outside an insurance plan to help maximize your medical savings. These cards can be helpful by giving you a discount for your out-of-pocket purchases for prescriptions, vision, or dental services. Think of them as a coupon card with prescribed savings only for certain medical services. GoodRX has saved my family about 70% on prescriptions as compared to contracted rates through insurance.

As these discount cards have become more popular and appealing to the general public, it is vital to note some significant limitations. First, consumers must take caution because some discount cards are fraudulent, marketing themselves as insurance and promising protection while charging with hidden fees. Ultimately, discount cards do not provide comprehensive health coverage or protection. However, for savvy shoppers, discount cards can be a great way to save money and reduce your overall monthly healthcare costs.

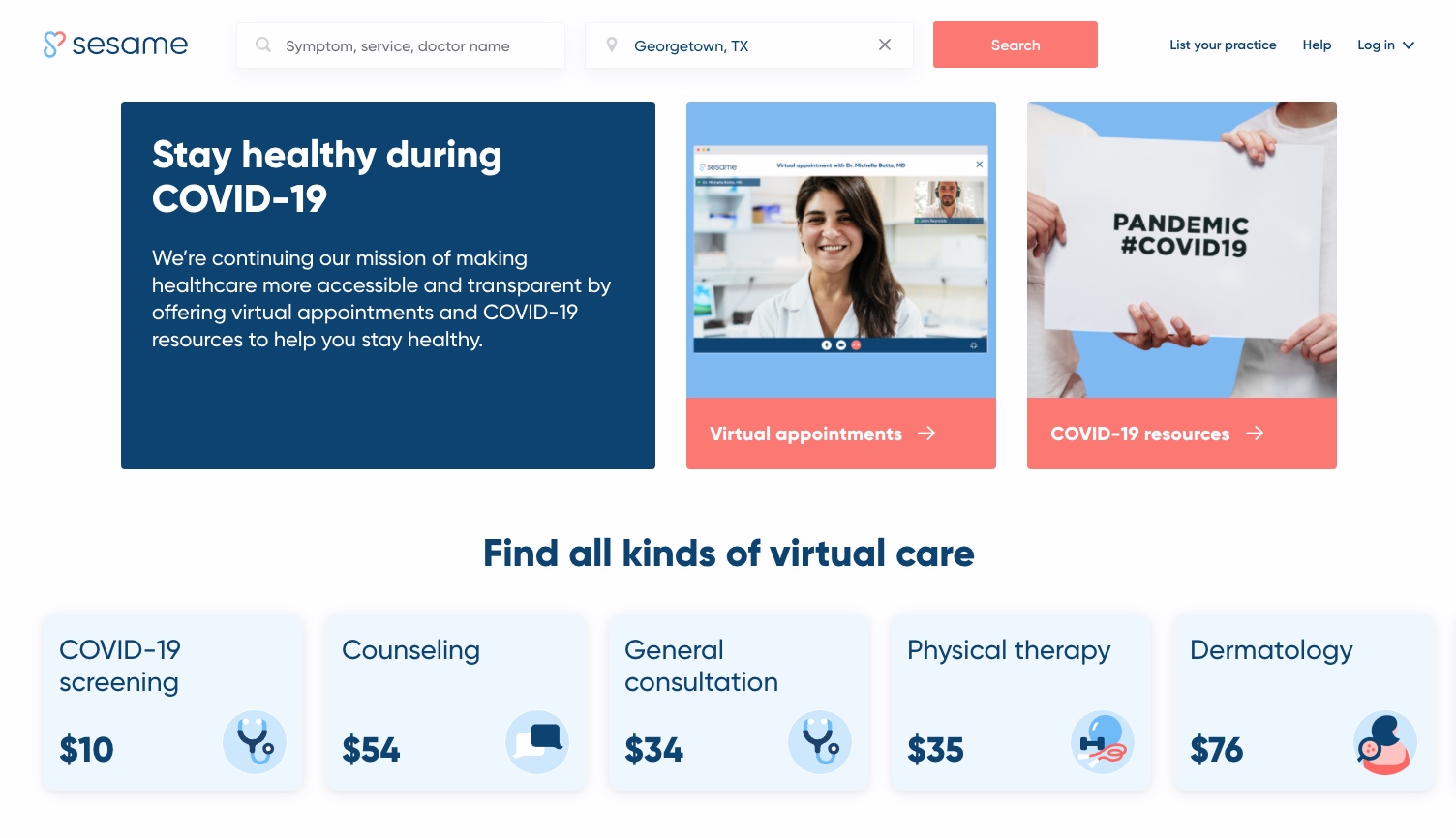

4. Medical Savings Subscriptions / Marketplaces

Subscription-based online medical shopping tools like Pratter can provide tremendous value to savvy consumers. Pratter includes cash prices for urgent cares across the country. It additionally offers "Money Maps" that direct consumers to affordable options for blood work, medical imaging, and surgeries.

Online marketplaces are emerging as well, like Sesame and Wow Health Solutions, that enable consumers to shop for self pay direct care health solutions.

"Having an agent like Renee Shannon (817-249-8200) of Today's Insurance Benefits compare products for you can be very helpful."

--- DR. CRISTIN DICKERSON, MD

5. Non-traditional Health Insurance Plans

The following companies provide underwritten plans that can be a good solution for many people:

They are more affordable than traditional plans but differ significantly. Make sure you understand what is and is not covered, having an agent like Renee Shannon (817-249-8200 or renee@todaysbenefitsgroup.com) at Today's Insurance Benefits compare products for you can be very helpful.

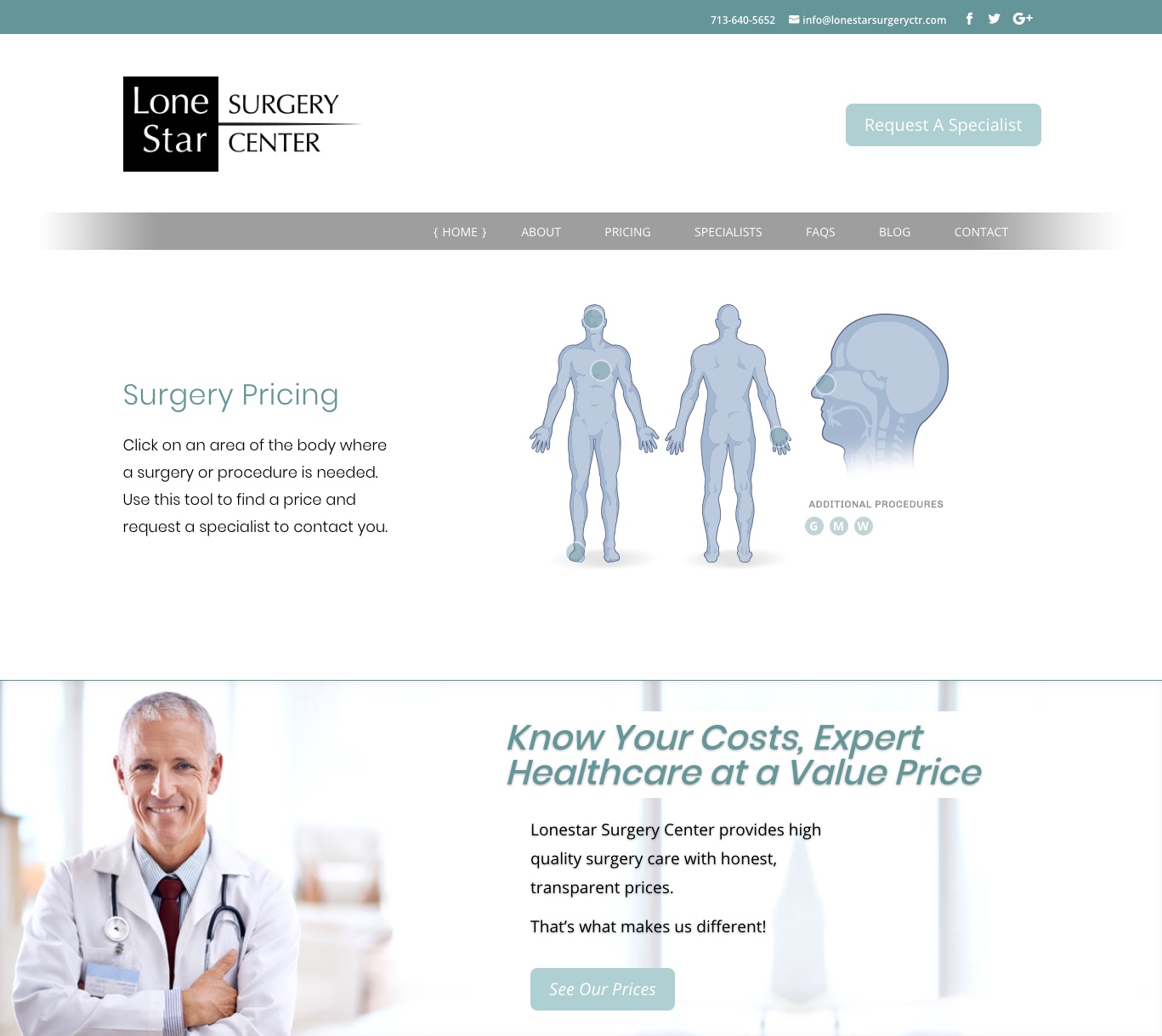

6. Direct Pay Cash

Traditional health insurance plans often come with a load of fees in addition to monthly premium payments. Not only do you need to make monthly payments, but most enrollees will also have to meet some kind of deductible threshold, pay a copay, as well as foot the bill for medical care their insurance doesn't cover. All of these extra charges make it unclear and difficult to know the real cost of what you need to pay. Once you add up all the additional costs, you might find that your health insurance plan isn't a great deal.

To avoid all the extra fees and stipulation, many consumers are simply paying directly out of pocket for their health care. The direct pay cash option simplifies the price tag into one, upfront fee, making the process transparent. There are no monthly premiums, no deductibles to meet, no copays, and no undecipherable coverage stipulation. You know exactly what everything costs.

Better yet, without the insurance company acting as a middleman between you and your healthcare provider, the process is less expensive, faster, and more transparent to you. There is no one else involved in a direct cash-pay transaction outside of you, your family, and your doctor or choice.

Our friends at Texas Free Market Surgery in Houston and Austin, Lonestar Surgery Center in Houston, and Surgery Center of Oklahoma offer bundled surgical pricing on their websites.

My husband had an urgent surgical procedure on January 2. The financial counselor suggested paying cash would be less expensive than the contracted rate through the network provided with his insurance. He paid $4,800 upfront. We later received a hospital bill for $40,000 and his cash payment had not been applied. He called to get his cash payment applied and was told it was paid in full. Our best estimate is that we have saved about $50,000 over 3 years since moving away from a traditional health insurance product.

These health insurance alternatives may not be the best option for people with chronic diseases and preexisting conditions, but some of these tools can be used in conjunction with a traditional plan to hold down costs.

My prediction is that the current health and economic crisis will grow this emerging market dramatically and offer all of us better and more affordable solutions.

Stay safe!

DR. CRISTIN DICKERSON, MD