America’s Healthcare Crisis in Graphs, Charts, & Numbers

Backseat Disaster

Back of mind and at the back of the legislative queue, healthcare seems to have taken a back seat on the stage of public discourse. It seems that after eight years of heavy-handed government intervention in the form of unreformed Affordable Care Act and two more years of congressional gridlock and half-baked solutions (remember “skinny repeal”?) that our elected officials are tired of talking about, fighting about, and battling over the future of American healthcare (or maybe their incentives are not aligned with reform?).

This is a mistake.

Healthcare is one of the defining challenges of our time and is "killing" our middle class. Simply putting it out of mind or on the backburner will not do. The truth is, while healthcare remains out of the headlines, costs continue to climb, premiums keep getting more expensive, health plans cover less and less, and the insurance middlemen and healthcare conglomerates continue to make an obscene profit at the expense of everyone else. However, since more than 50% of healthcare is funded by employers, not by the government, those with a close eye on the healthcare market are seeing the rumblings of change.

"Healthcare is one of the defining challenges of our time and is "killing" our middle class."

--- DR. CRISTIN DICKERSON, MD

Costs, By the Numbers

The Kaiser Family Foundation again has produced an excellent compilation of data documenting the rise of healthcare costs in America. Even to this day, prices continue to rise faster than wages, inflation, and the nation’s economic growth.

The underlying causes driving up healthcare costs continue to remain both broadly understood yet rarely discussed. High prices, malaligned incentives, entrenched middlemen, and third-party payers are but a few of the more prominent reasons health care in America remains a major financial burden for so many. While the impact of the latter three remains abstract and difficult to quantify, prices can be tracked accurately.

How Have Healthcare Prices Grown Over Time?

The following chart collections are provided courtesy of the Kaiser Family Foundation - Gary Claxton, Matthew Rae, Larry Levitt and Cynthia Cox | Peterson-Kaiser Health System Tracker

Click on any chart below to view chart in full-view.

Since the end of 2007, healthcare prices have grown 21.6%, while prices in the general economy (measured by the GDP deflator) have grown 17.3%.

A price index is a standardized measure of how average prices have changed over time. Prices for inpatient care have risen more rapidly for patients with private insurance when compared to prices for patients with Medicare or Medicaid. Between Mid-2014 and first quarter 2018, inpatient prices for patients with private insurance rose about 13 percent compared to about 3 percent for patients with Medicare and Medicaid, and about 6 percent for the general economy.

This recent faster growth in inpatient prices for the privately insured is the continuation of a longer trend. This chart, which updates and refines data presented here, shows that inflation-adjusted private prices for hospitals stays are higher than prices paid by public programs and have been growing much faster. In 2015, hospital inpatient prices for private patients were 68 percent above those for Medicare patients

The increase in private prices can be seen in the cost of some common inpatient procedures. In our analysis of employer claims data, we refer to “prices” as the weighted average of actual expenditures made for a given service by insurers and enrollees in the large employer market. The average price paid by large employer plans for an inpatient admission for a laparoscopic appendectomy increased by 136% between 2003 and 2016, much faster than general price increases over the period (28%).

There is a similar story for inpatient admissions for full knee replacements, where the average price paid by large employer plans increased by 74% between 2003 and 2016, compared to 28% increase in overall inflation.

As others have shown, there is considerable variation around average price paid for the same procedures. In 2016, while the average price paid by large employers for an admission for a full knee replacement was $34,063, 25 percent of admissions had a price of $24,734 or less and another 25 percent had prices higher than $39,786. Ten percent of admissions had prices in excess of $52,181 (53% above the average). For laparoscopic appendectomies, the average price paid for an admission was $20,192 in 2016; 25 percent of admissions had prices of $12,088 or less while another 25% had prices of over $24,847. Ten percent of admissions had prices in excess of $35,308 (75% above the average).

Average price paid by large employer plans for full knee replacements varied considerably across markets. This figure plots average prices in metropolitan statistical areas (MSAs) with more than 125 full knee replacements in the MarketScan data for 2016. For example, the average price of a full knee replacement in the New York City area ($50 thousand) is more than twice the price of the same procedure in the Louisville, Kentucky area ($23 thousand). The national average was $34,063.

Prices for outpatient office visits also grew much faster than general price inflation over the 2003 to 2016 period, rising from an average price of $60 to $101 or 69% compared to a 28% increase in overall inflation. Office visits are coded at five different levels (with other modifiers), depending on the scope of the services and level of complexity of medical decision making.

Outpatient visits with the highest level of acuity (the most severe and most complex cases) are coded as Level 5, while visits with for straightforward, minor conditions are coded as Level 1. Average prices increased for each of the five levels. From 2003 – 2016, the average price for Level 1 visits increased by $21 or 85% (compared to 28% of general economic inflation) and the average price for Level 5 visits increased by $62 or 52%. The average price of Level 3 visits, which are the most common, increased by $30 or 54% from 2003 – 2016.

The share of office visits coded as Level 4 (moderate to high severity) increased, while the share coded as Level 3 or lower complexity/severity decreased over the 2003 to 2016 period. The share of office visits coded as Level 3 dropped from 60% to 52% while the share coded at the higher level-4 increased from 19% to 36% over this period. The share of visits at the lower level-2 also decreased, from 14% to 7%, over the period.

Average price paid by large employer plans for outpatient visits varied considerably across markets. This figure plots the average price in the largest 25 reportable metropolitan statistical areas (MSAs) with more than 1000 outpatient office visits in the MarketScan data for 2016. For example, the average price for an outpatient office visit in the Minneapolis, Minnesota area ($158) is more than twice the average price in the St. Louis, Missouri area ($78). The national average was $101.

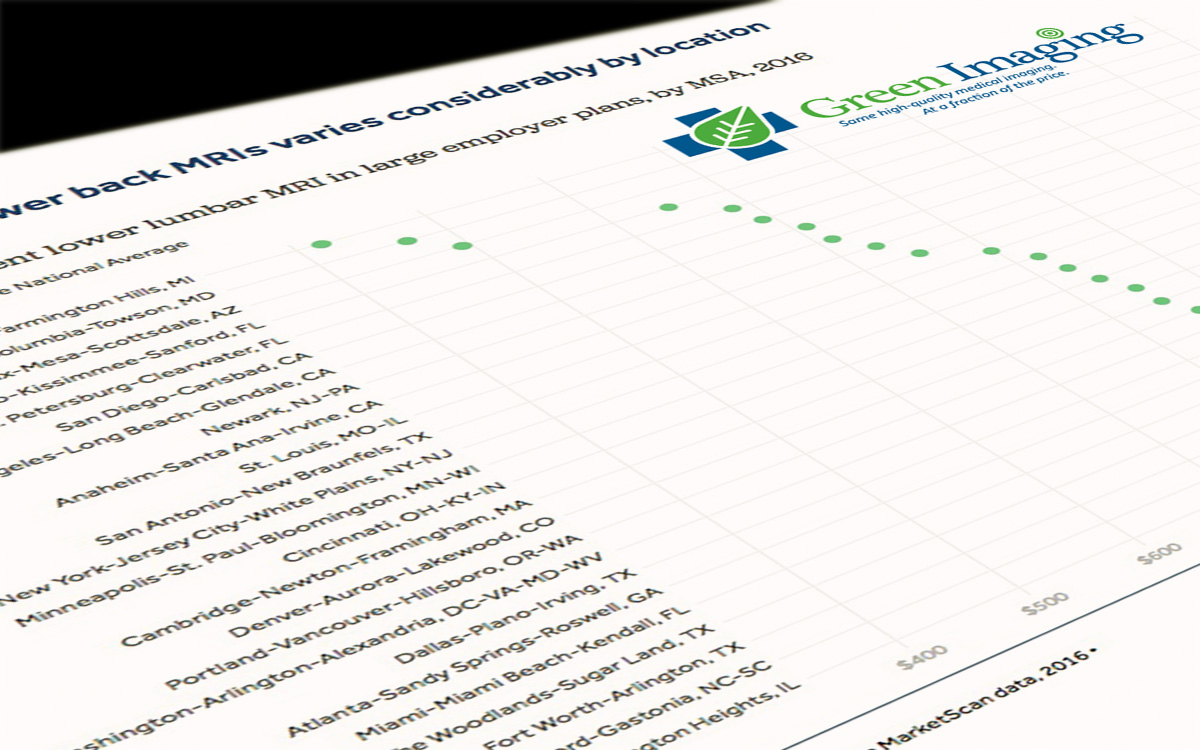

Not all services have rapidly rising prices. The average price paid by large employer plans for an outpatient MRI of the lower back rose only about 14% between 2003 and 2016, about one-half the increase in general price inflation over the period (28%). The prices here include the cost of the MRI itself and the professional cost of interpreting the result.

Average price paid by large employer plans for a lower-back MRI varied depending on the location in which it occurred. This figure plots average prices in the largest 25 reportable metropolitan statistical areas (MSAs) with more than 750 MRIs in the MarketScan data for 2016. The average price for a lower-back MRI in the Chicago, Illinois area ($1,123) is more than twice the average price in the Baltimore, Maryland or Farmington Hills, Michigan areas. The national average was $894.

The data provided by The Kaiser Family Foundation tells a story of healthcare price inflation untethered from general economic indicators.

"The underlying causes driving up healthcare costs continue to remain both broadly understood yet rarely discussed."

--- DR. CRISTIN DICKERSON, MD

Following are two of the biggest takeaways from the charts above.

First, prices for procedures have no rhyme or reason and can vary widely depending on a variety of “market” factors, including geographic location and the so-called list price of the provider.

The charts show that a procedure as common as a knee replacement varies widely in price, from $23,000 to $50,000. The same price differentials for simple, commonplace procedures are seen uniformly across the board. This is readily apparent to us and our patients in the pricing of diagnostic imaging procedures. A basic MRI can range in price from a few hundred dollars to over ten thousand dollars in the same city. The cost may even very dramatically from payor-to- payor. While a contracted rate with insurance is frequently over one thousand dollars, the cash price at the same facility may be in the five hundred dollar range. And then again, unbundling may impact imaging; while a mammogram itself may be reasonably priced around $175, the interpretation may be billed separately and cost over twice that much.

Second, private insurance experienced some of the steepest increases in prices.

The Free Market Is Not So Free

These unreasonable price differentials seem to be indicative of an industry where the free market is clearly being obstructed in some form or fashion. Under normal market principles, an informed consumer will choose the best medical service at the lowest or very competitive price. Prices, therefore, tend to reach a balance point between what patients are willing to pay and what service providers are willing to charge. Price differentials this extreme indicate that consumers either lack the knowledge to make informed choices or lack choices altogether. In the case of healthcare, both a lack of transparent pricing information and a lack of choice are driving healthcare costs higher and higher.

Trade Secrets

The majority of consumers aren't aware of what their medical procedures should cost. Health insurance providers and many third-party payers disguise and hide the true costs of medical procedures as well as conceal negotiated prices protected as trade secrets. This makes it impossible to be an informed consumer because there is no price transparency.

Compounding The Lack of Price Transparency

The same challenges face employers who strive to offer health benefits for their employees. Compounding the lack of price transparency is a genuine lack of choice in medical products and services in many sectors and regional markets. They also frequently place employees who do not have the tools to understand the import of healthcare decisions on behalf of their employer in the decision making role.

Many segments of the healthcare industry are dominated by one or two big players with little to no meaningful competition. Much like cable companies, many providers such as hospital conglomerates and outpatient facility chains have carved out monopolies in their local markets. When there is only one hospital within driving distance from your house, you are essentially forced to pay whatever they ask you to pay.

Crisis, By the Numbers

The consequences of rising healthcare costs are far-reaching. The financial burden alone on individual families, particularly middle-income families, and on the economy as a whole is staggering.

The cost of health care premiums and expenses for a family of four in 2018 is $28,000.

56 million people struggled to pay health care related costs. Over 50 percent of Americans do not have $400 to spare, but the average health care deductible is $1500.

About 17 percent of those who struggled with healthcare costs took a year or longer to pay off their particular healthcare bills. Another 9 percent couldn’t pay at all.

Remember, this is all money that families could have spent saving for retirement, starting a business, paying bills, sending their kids to college, and, in some cases, putting food on the table.

Over 70 percent of those burdened by medical bills skimped on groceries, clothing, rent, or all three.

About 60 percent blew through their life’s savings.

More than 40 percent took on extra work to pay the bills.

More than 50 percent of Americans are functionally uninsured. They spend 15 percent of gross earnings on a healthcare premium for a policy they cannot afford to use.

According to The Kaiser Family Foundation, medical bankruptcy was the number one cause of bankruptcy for adults. It’s not hard to see why. When one visit to the emergency room and follow up operations can easily set a patient back hundreds of thousands of dollars, those without health insurance are just one accident away from complete financial ruin. Even those with health insurance are finding it harder and harder to deal with rising premiums, higher deductibles, and the advent of so-called catastrophic plans that cover only the most expensive, life-or-death procedures and force consumers to bear all other medical costs.

Of course, medical bills and bankruptcies also have a severe impact on the broader economy. Healthcare spending is eating up a larger and larger share of the national GDP and drives national debt. In 1960, healthcare ate up 5 percent of the economy as measured by national spending. Today that number is 18 percent. That is trillions and trillions of dollars that aren’t being spent on defense, education, infrastructure, and a host of other important national problems.

Furthermore, it is estimated that 30 percent of healthcare spending is simply wasted (or stolen) because of consumers' lack of choice and inability to make informed buying decisions. The opaque, uncompetitive nature of the entire healthcare system promotes unnecessary spending, price inflation, and waste.

3 Simple Solutions to Think About

Healthcare is complicated. The web of entangled interests, industries, and politics can’t be set straight with a simple prescription. There is no magic pill.

However, American innovation is offering great new opportunities in the individual and employer markets. Products are emerging that will allow Americans to take control of their healthcare costs and their health.

Progress is being made by proposing solutions, exploring alternatives, and reimagining the healthcare system from the ground up. To that end, I am proposing 3 simple solutions. Think of them as discussion starters, for how to begin untangling healthcare in America.

1. Put primary care back at the foundation of healthcare

An investment in Direct Primary Care (DPC), an emerging subscription-based model of primary care that provides 24/7 access to care that keeps patients out of the ERs and urgent cares and under the care of their own doctor 90 percent of the time. The 10 percent of time additional care is needed, the DPC doctor helps the patient navigate the healthcare system and find the highest quality care at the best price.

2. Improve Price Transparency

Make upfront and direct-pay pricing information available to all consumers and their DPC healthcare shepherds. Empower consumers with a choice by allowing them to shop around for the best care, with the best outcomes, at the best price.

3. Skip the Middlemen

The cost of premiums and out of pocket spend for a family of four is $28,000, but the cost of care for each person is typically in the $2,000-$3,000 range. The rest goes to middlemen. Some middlemen are necessary, but many are not.

There are emerging healthcare models and products that eliminate many of the unnecessary players.

The truth is, our healthcare system has been unaffordable, unsustainable, unbearable, inaccessible, and in dire need of change. Change can happen with a discussion and a concentrated effort to find a solution.

We are ready to do something different. The worst thing we could do is nothing at all.

How You Can Help Be A Part of the Solution

Help educate people on what is happening in healthcare. Share this post on social media.